ETH Price Prediction: Path to $5,000 Amid Supply Squeeze and Institutional Adoption

#ETH

- MACD bullish divergence and strong momentum indicators support upward price movement

- Whale accumulation and supply shock concerns creating fundamental buying pressure

- Institutional adoption through new tokenization standards providing long-term value support

ETH Price Prediction

Technical Analysis: ETH at Critical Juncture

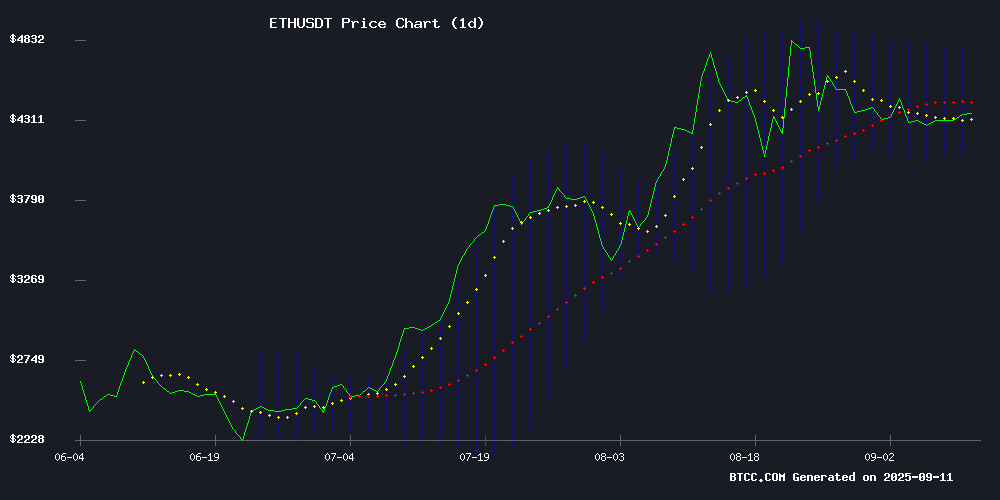

ETH is currently trading at $4,407.99, slightly below its 20-day moving average of $4,416.43, indicating potential consolidation. The MACD reading of 167.23 versus 102.81 shows bullish momentum remains intact, with the histogram at 64.42 confirming upward pressure. Bollinger Bands position the price between $4,708.97 (upper) and $4,123.88 (lower), suggesting $4,300 as crucial support. According to BTCC financial analyst Robert, 'The technical setup favors a breakout above $4,700 if ETH holds above the $4,300 support level, with the MACD divergence supporting further upside potential.'

Market Sentiment: Whale Activity Drives Optimism

Recent headlines highlight significant whale accumulation and supply shock concerns, creating bullish undertones despite short-term volatility. Institutional adoption through new tokenization standards and network activity surges provide fundamental support. However, ETF outflows and network outages present near-term headwinds. BTCC financial analyst Robert notes, 'The combination of whale accumulation and institutional tokenization developments creates a structurally bullish environment, though traders should monitor the $4,300 support level for any breakdown risks.'

Factors Influencing ETH's Price

BitMine's Massive Ethereum Accumulation Sparks Supply Shock Concerns

BitMine Immersion has made waves in the crypto markets by acquiring 319,000 ETH in just seven days—a billion-dollar bet representing 0.26% of Ethereum's circulating supply. This institutional-scale purchase signals deepening conviction in ETH's long-term value proposition while tightening available liquidity.

Analyst Paul Barron projects that maintaining this acquisition pace WOULD see BitMine demand 4.1 million ETH by 2025's end—equivalent to nearly 40% of exchange-held reserves. The scenario grows more acute when considering parallel institutional accumulation. "Smart money is positioning now," observes Barron, noting retail traders typically chase rallies only after major price milestones.

Market mechanics suggest accelerating deflationary pressure. With staking lockups and institutional withdrawals reducing liquid supply, Barron sees $15,000 ETH by December as mathematically plausible—though contingent on sustained demand from multiple large players adopting similar strategies.

Ethereum Whales Accelerate Accumulation Amid Retail Distribution

Ethereum whales are demonstrating unwavering conviction as the asset trades above $4,300, with addresses holding 10K-100K ETH adding 450,000 coins to their balances this week. This institutional-grade accumulation mirrors growing corporate treasury interest, creating a demand wall against retail profit-taking.

Exchange reserves tell the same story - 260,000 ETH have fled trading platforms since September, signaling a holder mentality. The altcoin successfully retested $4,500 resistance after breaking a descending trendline, though short-term holders have offloaded 500,000 ETH during the same period.

Not all demand is equal. While accumulation addresses show steady buying, their pace lags August's voracious appetite. The divergence between whale accumulation and retail distribution paints a classic bull market tableau: weak hands funding strong hands through premature exits.

Ethereum Network Activity Heats Up Amid Price Correction

Ethereum faces selling pressure after a parabolic rally, with ETH's price action showing signs of fatigue. Analysts debate whether this marks a healthy correction or the beginning of a deeper pullback. The cooldown follows months of relentless bullish momentum that pushed the cryptocurrency to all-time highs earlier this year.

Despite price uncertainty, on-chain data reveals robust network activity. ethereum recorded $1.4 million in fees within 24 hours, signaling strong demand for block space. Transaction volumes remain elevated, with sustained usage across DeFi and layer-2 ecosystems. This divergence between price action and underlying fundamentals suggests long-term confidence persists.

The coming weeks will test key support levels. Network strength may serve as an anchor for bulls if volatility continues. Ethereum's dominance in smart contract platforms remains unchallenged, even as traders take short-term profits.

Top RWA Firms Debut ERC-7943 Standard to Transform Institutional-Scale Tokenization

Leading real-world asset (RWA) tokenization platforms, including Bit2Me, Brickken, and Compellio SA, have collaboratively launched the ERC-7943 Standard—a modular Ethereum framework designed to enhance transparency and interoperability in institutional tokenization. The initiative addresses growing demand for open infrastructure as on-chain RWA valuations surpass $27 billion, with U.S. Treasuries accounting for $7.45 billion of that total.

Luxembourg-based Compellio and other participants position ERC-7943 as a viable alternative to proprietary solutions, emphasizing compliance without sacrificing composability. The standard’s release coincides with accelerating institutional adoption, evidenced by 1-month growth across multiple asset segments tracked by RWA.xyz.

Ethereum Price Predictions From Top Crypto Experts

Ethereum's price trajectory is under intense scrutiny as it stabilizes NEAR $4,350, with a 24-hour dip of just 0.24%. Trading volume stands at $31 billion, reflecting robust institutional interest. Analysts identify strong support at $4,300, with potential upside targets at $4,500 and beyond.

Market cap exceeds $520 billion, reinforcing Ethereum's dominance in decentralized finance. Conservative 2025 projections start at $4,000, while optimistic models surpass $6,000. The Pectra upgrade and layer-2 adoption continue to fuel bullish sentiment.

Meanwhile, emerging tokens like Remittix are gaining attention as potential challengers to Ethereum's market share. Institutional inflows suggest growing confidence in crypto's long-term viability, though volatility remains a constant companion.

Whale Accumulation and Supply Squeeze Fuel Ethereum's Bullish Momentum

Ethereum's price action shows signs of a potential breakout, with whale activity and tightening exchange supply painting a bullish picture. Over the past five days, large holders have accumulated nearly 4 million ETH—worth approximately $17 billion at current prices—suggesting institutional confidence in the asset's upside potential.

The timing of these acquisitions is notable. Whales absorbed supply during Ethereum's consolidation phase between September 5-10, indicating strategic positioning ahead of a possible move. This accumulation coincides with exchange reserves hitting a yearly low, with the exchange supply ratio dropping to 0.145 from 0.156 in late August.

Market dynamics now show the classic markers of a supply squeeze: decreasing availability on trading platforms amid steady demand. When whales lead and liquidity follows, rallies tend to gain momentum. The question isn't whether Ethereum has strength, but how far this institutional endorsement might propel it.

Ethereum Faces Volatility Trap as $4.3K Support Hangs in Balance

Ethereum's price action at the $4,300 level has become a battleground for bulls and bears, with the asset trapped in a two-week range between $4,270 and $4,300. Market dynamics mirror mid-June conditions when ETH consolidated before a 40% surge, but critical divergences suggest weaker underlying support this time.

The Relative Strength Index (RSI) shows no accumulation pattern, while Binance data reveals a concerning 70% long skew. Spot ETF outflows totaling $96.7 million over six days contrast sharply with the $500 million inflows that fueled June's rally. Open Interest growth now signals potential bearish positioning rather than organic demand.

TradingView charts indicate Ethereum may need to sweep lower liquidity pools before any sustainable reversal. The equal 49-50% long/short ratio creates a razor-thin balance where stop hunts could trigger violent moves in either direction.

Ethereum Core Developers Earn Below Market Rates Despite Critical Role

Ethereum's Core developers are significantly underpaid compared to industry standards, according to a new report by Protocol Guild. The collective, which funds approximately 190 contributors, revealed median base salaries of $140,000—50% to 60% below market offers averaging $359,000.

One developer reportedly declined a $700,000 package to continue working on Ethereum's infrastructure. Only 37% of contributors receive token or equity grants, highlighting the financial sacrifice made by those maintaining the world's second-largest blockchain.

Linea Network Suffers Outage Hours Before Planned Airdrop

Linea, a prominent Ethereum LAYER 2 chain, experienced a significant outage on Wednesday as block production halted for over an hour. The disruption, traced to the sequencer's centralized approval mechanism, temporarily froze bridged ETH transfers and other on-chain activities. Operations resumed shortly after, but the incident cast a shadow over the network's highly anticipated token distribution event.

The airdrop, delayed from late 2024 to capitalize on favorable market conditions, represents a strategic MOVE by Linea to join September 2025's wave of active token distributions. This timing aligns with Ethereum's growing Layer 2 ecosystem, where chains like Linea increasingly handle substantial portions of the network's DeFi activity.

Institutional Outflows Hit Ethereum ETFs as Market Watches for Q4 Recovery

Ethereum faces a surprising slowdown as institutional ETF inflows plummet to multi-month lows. The Bitfinex Alpha report highlights a sharp decline in demand, casting doubt on the cryptocurrency's near-term prospects.

With prices lingering 15% below all-time highs, institutional hesitancy mirrors broader economic uncertainty. Meanwhile, retail-focused tokens like BullZilla ($BZIL) gain traction, raising $320,000 in its Stage 2 presale with 23.8 billion tokens sold.

August's final week saw Ethereum ETF net flows collapse to 16,600 ETH daily—down from 85,000 ETH—before reversing to 41,400 ETH daily outflows by September. A single-day withdrawal of 104,100 ETH (worth $447 million) underscores growing caution.

Analysts point to Federal Reserve policy ambiguity, inflation data, and geopolitical risks as key drivers. These outflows, while potentially temporary, reveal Ethereum's sensitivity to macroeconomic headwinds.

Ethereum Price at Critical Juncture as Bulls and Bulls Battle for Control

Ether's price action has entered a decisive phase, oscillating near the $4,200-$4,300 support zone after failing to sustain momentum above $4,600. The second-largest cryptocurrency now faces a technical inflection point, caught between an ascending trendline from August lows and a descending resistance level that has capped recent rallies.

Market structure suggests a breakout in either direction could determine the next major move. Holding above $4,300 remains crucial for bullish continuation, while a breakdown might test lower support levels. The tug-of-war reflects broader market uncertainty as traders weigh macroeconomic factors against growing institutional interest in Ethereum's network upgrades.

Will ETH Price Hit 5000?

Based on current technical indicators and market fundamentals, ETH has a strong probability of reaching $5,000 in the medium term. The convergence of whale accumulation, supply shock dynamics, and institutional tokenization developments creates favorable conditions. Key resistance levels to watch are $4,700 (Bollinger upper band) and ultimately $5,000. However, maintaining above $4,300 support remains critical for this bullish scenario.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $4,407.99 | Testing 20-day MA support |

| Immediate Resistance | $4,700 | Bollinger Upper Band |

| Critical Support | $4,300 | Bull/bear battle line |

| Target Price | $5,000 | Psychological & technical target |